Perspective Update | November 2022

Economic Competitiveness Edition

|

|

|

|

|

|

Nevada was recently ranked the number one state for economic momentum, and LVGEA has spent 2022 building off that excitement. As we head into 2023, there is a strong sense of optimism about the future of the Greater Vegas economy. In this economic competitiveness edition of the Perspective Update, you’ll find insightful commentary from UNLV’s Dr. Bo Bernhard, who argues innovation is fueling a new era of economic development in Southern Nevada. Plus, keep your finger on the pulse of the community with our survey results measuring the region’s attitudes towards our current business climate and how we compare to other markets. You’ll also find updated market information, and an economic update from Applied Analysis’ Brian Gordon. |

Guest Columnist |

Las Vegas Grows More Competitive |

|

|

Lost amid the cheering of fans at Allegiant Stadium and T-Mobile Arena are whispers that Las Vegas has gone overboard investing in sports and venues. Our visitor volume and population base are too small, it’s argued, to support more teams and more arenas. How could a city that had zero big league sports teams a half-decade ago now be ready for Major League Baseball and the NBA on top of the Raiders, Golden Knights, Aces, and a half-dozen minor league franchises? Are there enough fans to fill the nearly 150,000 stadium and arena seats that have been added or proposed over the last few years? But what if rather than being out on a limb, Las Vegas is ahead of the curve and becoming more economically competitive? What if this development both leverages tourism in ways never before seen in sports — while also diversifying the economy into entirely new sectors? This is precisely what is happening in Las Vegas. Worldwide, people just want to have fun, and spending on the “fun economy” is on the rise. At UNLV, we define this “fun economy” as tourism + sports + entertainment — and amazingly, tourism alone reached 10% of the planet’s economy just three years ago. When you add in sports and entertainment, you’re talking about roughly 15% of the global economy — every dollar, peso, euro spent on earth. So whereas Las Vegas might once have been dismissed as “fun, but unimportant,” those who would say that today would do so in ignorance of recent macro trends. And these trends seem certain to continue in the years ahead, as the global middle class swells by billions of people. In Asia, Latin America, and Africa, large portions of the population are moving from just getting by to being able to enjoy more of life’s pleasures. By 2030 fully half of the planet’s inhabitants will have joined the middle class — an unprecedented rise — and what’s the first thing you buy after you’ve bought all of your necessities? Fun. You buy fun! History tells us that when affluence rises, so does spending on entertainment diversions. And as a global thought leader in the fun economy, Las Vegas stands uniquely poised to take advantage of that trend while also dynamicizing its own economy. Delegations from around the world routinely visit my office looking for ways to emulate Southern Nevada’s fun economy. They hear about our diverse workforce and its ability to create and staff world-class resorts, draft effective gaming regulations, and improve sustainability in the hospitality industry. Put simply, nobody else has our workforce when it comes to the social intelligence required to understand what makes people have fun — and to grow the fun economy. These delegations are reminded that everything they see — from the resorts, to the architecture, to the landscape itself — was not gifted to the region by geography (as it is in a coastal town). Rather, everything driving 40+ million tourists to visit the city was imagined in the minds of Las Vegans and created with their skilled hands. Viewed through these lenses, Las Vegas has always been innovative, and now, alongside LVGEA and UNLV, we have a new innovation ecosystem to support this spirit. To take advantage of those new opportunities, UNLV President Keith Whitfield has renewed our focus on partnering with industry and preparing our students to make sure the supply of sharp minds meets demand. One example that is close to my heart is the recent opening of the UNLV Tourism Business Igniter on the campus of Nevada Partners on Lake Mead Boulevard, right in the heart of our urban core. This igniter will help local businesses to compete for contracts and launch startups with a tourism focus, leveraging the expertise of UNLV’s No. 1-ranked Harrah College of Hospitality, our Small Business Development Center, and our brilliant faculty. As Las Vegans we should all be proud that the strength of our tourism sector is so great we can diversify from this industry, as robotics technologies (launched by our UNLV robotics team) grow from serving our drinks to serving in our homes, as waterless bedsheets (as with our Purlin technology) become hospital bedsheets, and as AI technology (as with our AI Media Lab group) shifts from entertainment avatars to avatars for you and for me. Together, we are both developing and diversifying — often in interconnected ways that are the envy of the planet’s economy. Bo Bernhard is a fifth-generation Nevadan and winner of the 2022 LVGEA Leadership Award. |

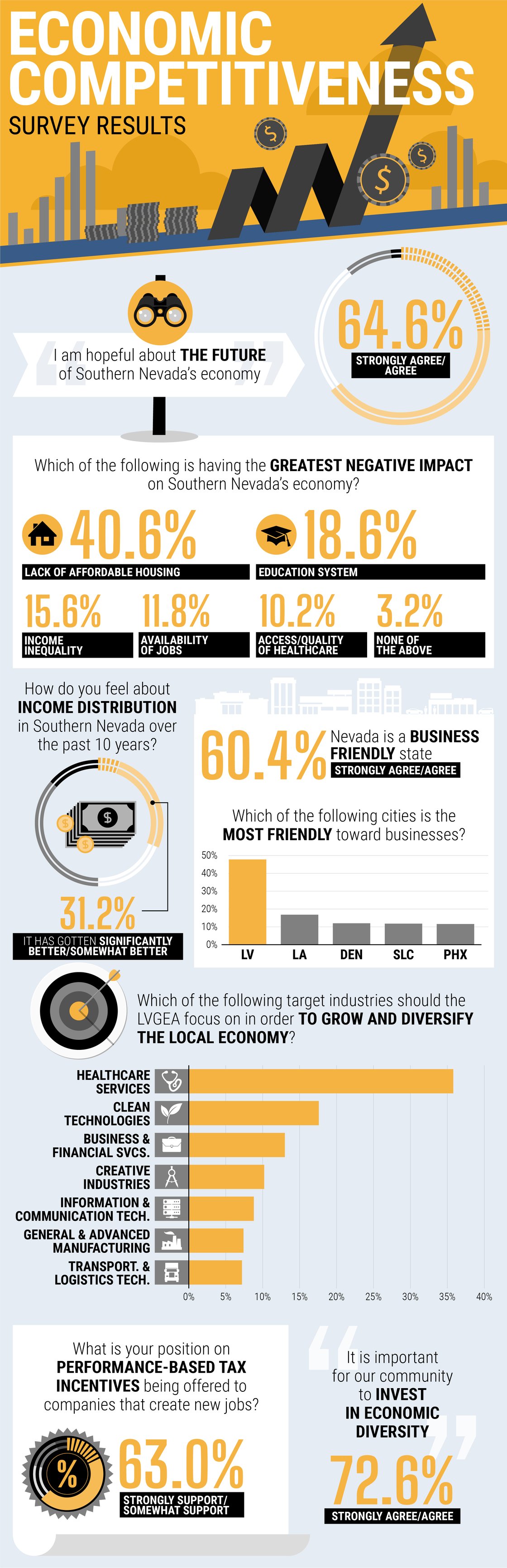

Economic Competitiveness Survey |

|

This community survey examined opinions and attitudes of the Southern Nevada workforce testing sentiments around our region’s economic competitiveness. This web-based survey was commissioned by Las Vegas Global Economic Alliance and conducted in Spring 2022. Since this survey is intended to poll the Clark County workforce, results remove self-selected retirees and unemployed workers as well as self- selected residents of other counties. The sample size of the survey is 500 with a margin of error of +/- 3.7 percent at the 90 percent confidence interval. |

|

Updated Regional Economic Statistics |

|

Economic Perspective |

|

|

The Southern Nevada economy posted positive growth in the latter half of 2022 as employment eclipsed pre-pandemic levels and visitation edged closer to usual volumes. For the most part, the economy appears to be moving on from the aftereffects of the COVID-19 pandemic, but concerns over rising inflation and diminished consumer confidence are certainly not to be ignored. Total employment reached 1,066,900 in September 2022 (latest available data), a 5.0 percent growth rate from one year ago. These latest employment figures mark a recovery of all jobs lost during the height of the COVID-19 pandemic, plus the addition of 17,200 new positions. Nationwide, Las Vegas ranked in the top ten percent of metropolitan areas with the fastest year-over-year growth (compared to 351 metro areas). Further, employment growth in the Las Vegas area outpaced the average United States’ growth rate of 3.7 percent (September 2022). On the unemployment side of the equation, the overall unemployment rate for the region in September 2022 fell for the third straight month to 5.3 percent, marking a 1.3 percentage point decline compared to the previous year. Despite significant improvement from the low point witnessed in April 2020 (31.1 percent), the unemployment rate remains elevated by 1.8 percentage points from the pre-pandemic peak of 3.5 percent (February 2020). Compared to all large metro areas, Las Vegas holds the highest unemployment rate and lags behind the national unemployment rate by 2.0 percentage points. Visitation picked up in September 2022 following a slow August, with 3.4 million visitors coming to Southern Nevada, up 14.3 percent on the year. On a trailing 12-month basis, visitation reached 38.1 million, up 39.4 percent from one year ago and the highest value experienced since March 2020. Traffic at Harry Reid International Airport has trended similarly, with 4.8 million passengers coming through its gates in September 2022, up 25.9 percent year-over-year. September’s passenger volume was the second-highest month in history, falling just 2.2 percent behind the record-setting 4.9 million passengers observed in July 2022. Further, 50.6 million passengers have moved through the airport in the last 12 months, a value not seen since February 2020. As a result of the increased visitation in September, hotel occupancy increased to 83.1 percent (+10.1 year-over-year), while revenue per available room (RevPAR) swelled to a record of $155.55 (+36.8 percent year-over-year). Meanwhile, gaming activity has continued to trend upward, posting revenues of $1.1 billion in September 2022, up 5.6 percent from the previous year. This marks the fifth consecutive month of revenues above $1.0 billion in Clark County, contributing to all-time high trailing 12-month revenues of $12.7 billion (+25.6 percent year-over-year). Despite these gains, convention attendance remained muted but continues to recover from the effects of pandemic-related interruptions. In the 12 months ending September, 4.6 million convention attendees visited Southern Nevada, down 31.8 percent from the pre-pandemic peak of 6.7 million convention attendees in February 2020. After more than two years of consistent price hikes and sky-high sales volumes, the Southern Nevada housing market has seen some significant changes in the past few months. The median price for single-family homes peaked in May 2022 at $482,000 but has declined by 8.7 percent over the last five months to $440,000. However, median prices represent a year-over-year growth rate of 7.3 percent. Sales volumes have also fallen, with 1,724 single-family home sales recorded in the latest period, down 44.0 percent from one year ago. Meanwhile, availability has loosened as the effective months of available inventory increased to 4.6 in October, up from 1.1 months during the same time last year. Importantly, the absolute number of homes listed for sale has held in a tight range of about 10,000 units (single-family and multi-family properties). The shift in housing market conditions is largely the result of rising mortgage interest rates and broader housing affordability challenges. Rising mortgage rates have been impacted by inflationary pressures and the Federal Reserve’s response with rising interest rates. After holding the federal funds target rate at historically low levels for two years, the Federal Reserve has raised the rate six times in 2022. This has translated into escalating mortgage interest rates. The average 15-year and 30-year fixed mortgage rates climbed to 6.15 percent and 6.90 percent, respectively, as of October 2022. While rising mortgage rates have cooled homebuyer demand, the Southern Nevada housing market benefits from strong in-migration metrics, especially from its western neighbor California. During the 12 months ending September 2022, Clark County welcomed 73,721 new residents (measured by exchanged out-of-state driver’s licenses). California maintained the top spot for the highest share of newcomers, accounting for 38.7 percent of all incoming residents. Other top states driving in-migration to Clark County include Florida, with a 4.9 percent share of all license surrenders, Texas (4.6 percent), Washington (4.4 percent) and Arizona (4.2 percent). Broad economic measures in Southern Nevada remain on a path for recovery despite potential headwinds. During the last quarter, employment continued to improve while the unemployment rate dropped. The tourism industry has also seen increasing visitor volumes, as well as rising room occupancy and rates. With inflation at a 40-year high and talks of a potential recession gaining traction, it will be important for the region to continue to press forward during the final months of 2022. |

|

|

|

This newsletter is made possible with the support of our PERSPECTIVE Council: |

|

|

|

|

|

|

|

%20Header%20Nov%202022.png?width=1120&upscale=true&name=Perspective%20(Economic%20Competitiveness)%20Header%20Nov%202022.png)