Perspective Update | June 2023

Economic Competitiveness Edition

Over the past decade, Nevada has been the fortunate beneficiary of new, innovative industries who now call Nevada ‘home.’ But Greater Vegas is losing its edge when it comes to the region’s economic competitiveness amongst our neighboring states.

Last November, national Site Selector magazine published its annual “Top State Business Climate” rankings, listing the top 25 states in which to do business. Nevada didn’t even make the list. The fact is, Nevada is no longer perceived as a top business destination. Nevada needs to do better.

In my most recent TQ Takes column, I look at Nevada’s economic competitiveness, and why the state needs a long-term, consistent strategy that positions us as friends to business.

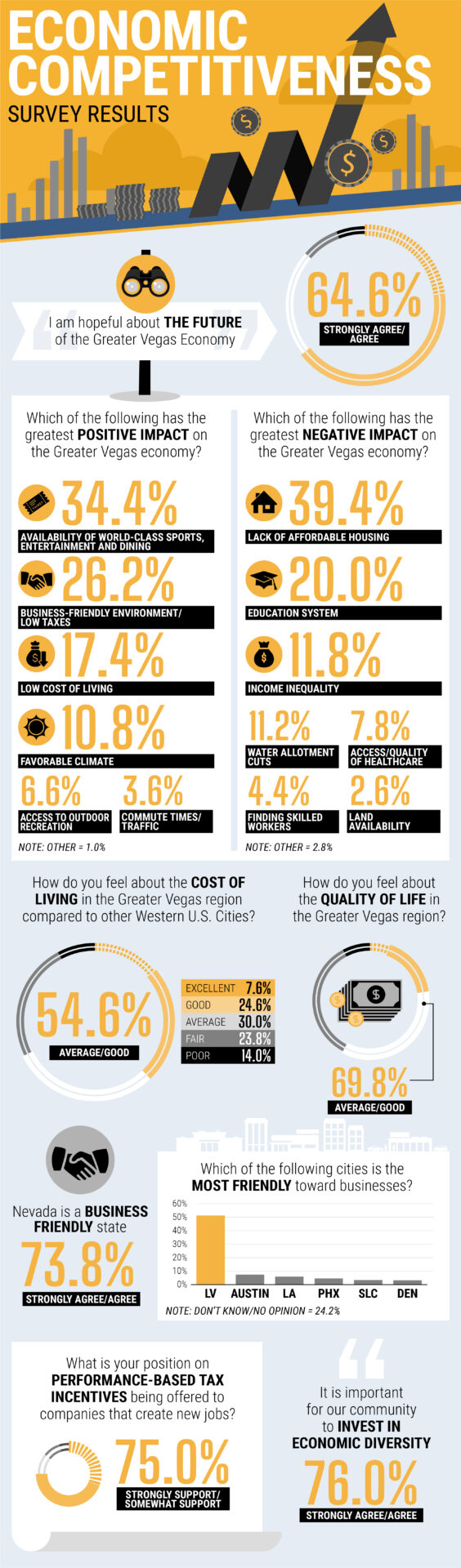

In this Perspective Update newsletter, you’ll also find an economic update from Applied Analysis, plus the results of a community survey that show 76% of Southern Nevadans think it’s important to invest in economic diversity. We agree, and we’ll keep working towards that goal!

ECONOMIC COMPETITIVENESS SURVEY

This community survey examined the opinions and attitudes of the Greater Vegas workforce, testing sentiments around our region’s economic competitiveness. This web-based survey was commissioned by the Las Vegas Global Economic Alliance and conducted in Spring 2023.

Respondents were selected from the current Clark County workforce and do not include retirees, students and other unemployed workers. The sample size of the survey was 500 with a margin of error of +/- 4.4 percent at the 95 percent confidence interval.

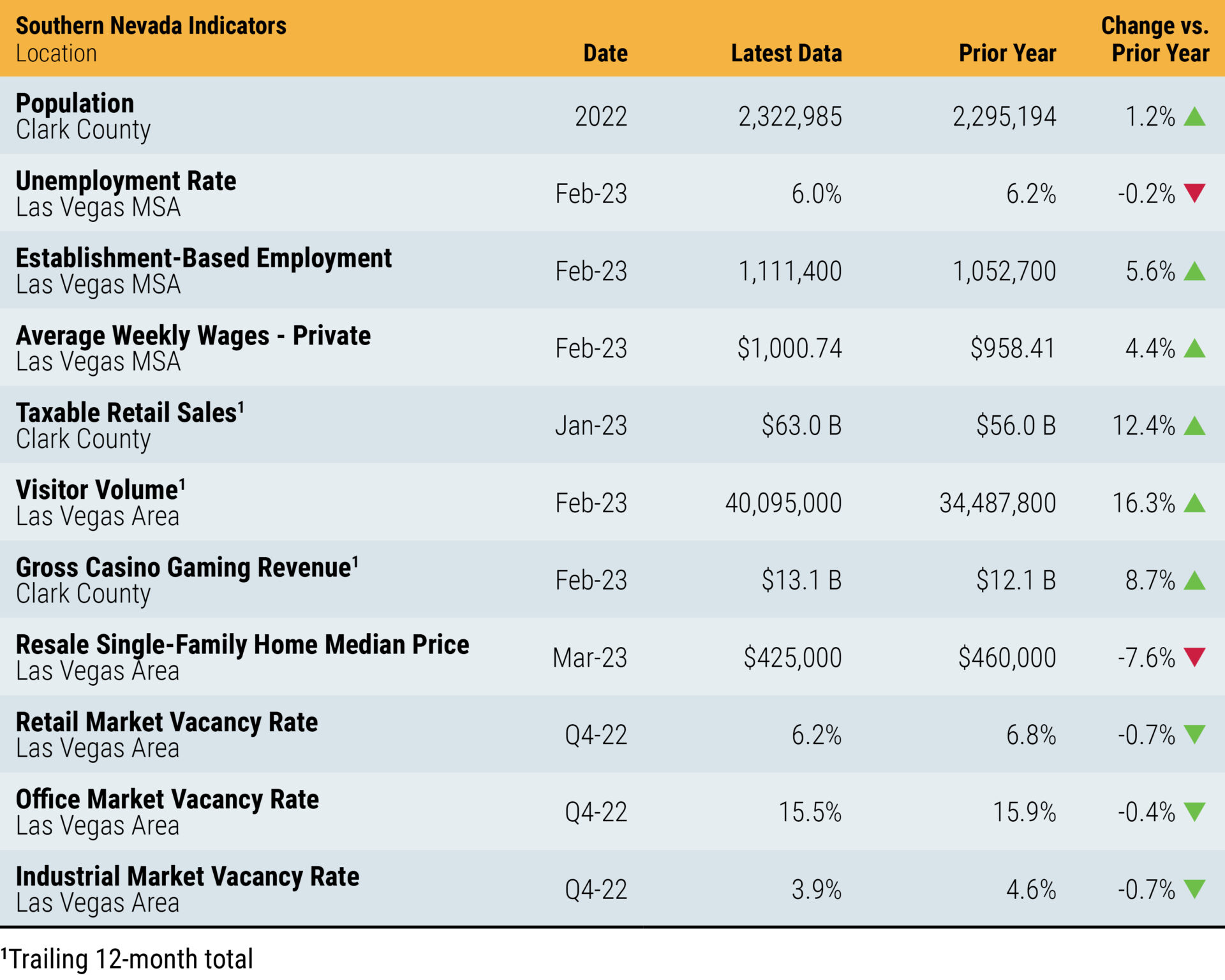

UPDATED REGIONAL ECONOMIC STATISTICS

ECONOMIC PERSPECTIVE

Southern Nevada’s economic competitiveness is a key contributor to the region’s growth. Trends in current population, employment and gross domestic product reveal an expanding regional economy, and in-migration data suggest the Las Vegas metropolitan area is an attractive destination for new residents and businesses alike.

Total employment in Las Vegas reached 1.1 million in February 2023, representing growth of 58,700 jobs from the year prior. Employment growth in Las Vegas between February 2022 and February 2023 (+5.6 percent) outpaced the national average (+2.9 percent) over the same period by nearly 2.0 times. The unemployment rate in the region has risen seasonally in the first two months of 2023 largely due to more people entering the workforce, but February’s 6.0 percent rate is 0.2 points below last year’s levels. For reference, the national unemployment rate (3.9 percent) is down 0.2 points year-over-year. While Las Vegas has the highest unemployment among large United States metropolitan areas, Nevada had the largest growth among all states for its labor force entering 2023 at 4.3 percent.

A growing job market has tracked with population growth in the Silver State and southern Nevada, in particular. Nevada’s population grew by 1.0 percent in 2022 to 3.2 million, double the national growth rate of 0.5 percent. At the same time, Clark County saw its population grow by 27,791 residents to 2.3 million. However, near-term, local indicators suggest potentially stronger growth. Total drivers’ licenses surrendered to Clark County hit 63,695 in February 2023 (trailing twelve-month total), with almost 40.0 percent (24,275) coming from California. The low cost of living enhances the attraction of doing business in the Las Vegas area. Living in Las Vegas is up to 77.0 percent cheaper than other western metro areas, including Phoenix, Denver, Portland, San Diego, Seattle, Los Angeles, and San Francisco.

Average weekly wages in Las Vegas grew 4.4 percent year-over-year in Las Vegas, reaching $1,001 in February 2023. Las Vegas wage growth was higher than in other western metropolitan areas such as Phoenix (+3.3 percent) and Los Angeles (+2.6 percent growth), helping attract and retain a quality workforce. Rising employment, population and wages have combined to drive gains in Nevada’s gross domestic product (GDP) over the last year, with the state GDP up 11.0 percent in 2022, surpassing the national growth rate of 9.2 percent.

Southern Nevada’s continued growth and diversification have made it a prime region for business relocation. A recent study found that Las Vegas was the top destination for businesses leaving California, accounting for double the number of moves of any other location. Between 1990 and 2019, 2,832 firms moved from California to Las Vegas. Henderson also made the top ten (ranked seventh), with 771 business relocations during that time. Together, Henderson and Las Vegas accounted for 5.5 percent of all businesses (3,603 companies) moving out of California during the study period.

Further, in a survey of senior executives at privately-held Western United States Fortune 1000 companies, Nevada was rated as the best state for new corporate investment in 2022 based on its tax and business climate, beating out second-place Arizona by eight percentage points. Nevada’s pro-business tax environment (no individual income tax and moderate business taxes) makes it an attractive location, and The Tax Foundation, which ranks states by their business tax climate, has ranked Nevada seventh overall in the nation for best tax climate. Additionally, a study from Crowdfund Capital Advisors listed Las Vegas as the best city in America for pre-IPO startups.

While economic headwinds around interest rate increases and inflation will likely persist further into 2023, Southern Nevada’s economy is trending positively, reinforced by the region’s economic competitiveness as evidenced by employment, population and GDP growth.

This newsletter is made possible with the support of our PERSPECTIVE Council: